Flag Pattern: Definition, Types, and Trading Strategies

Flag chart patterns get their name from looking like a flag on a pole, and show up as short breaks in the main trend. Understanding flag patterns, alongside their close relative pennant patterns, helps traders make informed decisions. They belong to the flag and pennant category and indicate that the trend might continue (continuation patterns) instead of changing.

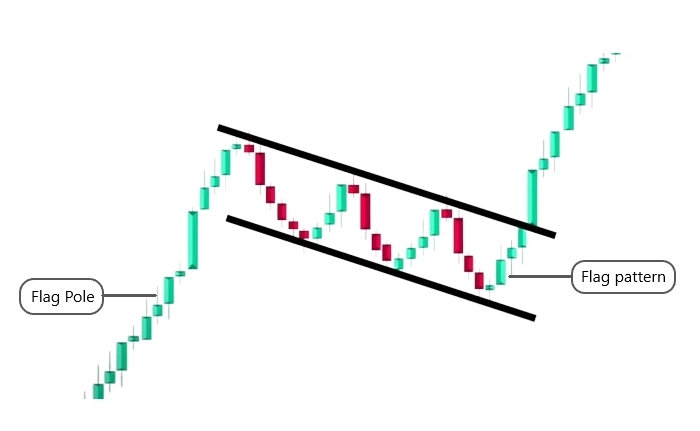

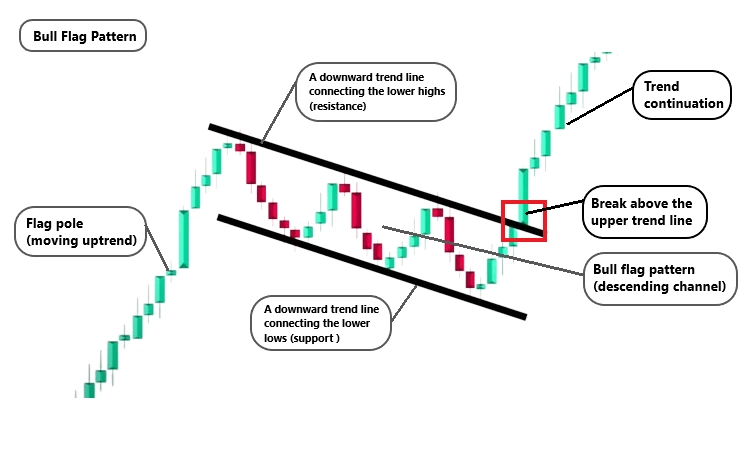

The "pole" shows a sudden change in price, while the "flag" shows that the price has settled in a small range, either in the shape of a rectangle or a parallelogram. There is a short time of activity during this consolidation. This is usually a sign that the market is taking a break before going back in the same direction it was going in.

Understanding flag trading patterns is important because they show how strong and long-lasting trends are. They show how the market works, where there is a short-term balance after a big price change while buyers and sellers get used to the new prices. After the breakout from this pattern, the original trend often starts up again, giving traders chances to enter or add to their positions with more confidence.

Using flag patterns is especially helpful in unstable markets and prices change quickly. With the help of technical analysis's ability to predict the future, traders can improve their strategies by finding these trends. Bullish or bearish markets both use the flag trading pattern as a reliable indicator to help predict price changes and get the best trade results.

After understanding Flag Chart Patterns, dive deeper into Triangle Chart Patterns.

What Is a Flag Chart Pattern?

The flag is a type of crypto chart pattern in trading used to find possible signs that a trend will continue. The name of this pattern comes from the way it looks like a flag on a pole. The "pole" is a quick move in one direction of the price, and the "flag" is when the price stays in a narrow, usually rectangular or parallelogram-shaped range.

In this pattern, the flag part shows a short break in the trend, marked by a time of consolidation or small countertrend movement. The traders take a break after a big price change, which creates a short-term balance between buying and selling forces.

Once this phase of stabilization is over, the price usually breaks out in the direction of the previous trend, indicating that the trend will continue rather than turn around. A rise in volume normally happens at the same time as this breakout, which confirms that the initial trend is back on track. Traders use flag trading patterns to find starting points that are in line with the movement of the market as a whole. This helps them take advantage of long-term trends.

So that, a flag chart pattern tells traders and investors how strong and long-lasting a trend is, which gives them an edge when predicting how prices will move in the future.

How to Interpret a Flag Pattern?

To interpret a flag pattern, you need to be able to spot it and figure out what it means for future price changes.

Start by finding the flagpole, which is the sharp, almost straight price change that comes before the flag. Finding it sets the stage for the trend, which can go up or down.

After that, search for the actual flag. During this consolidation phase, the price moves in a constrained range and forms a parallelogram or rectangle-like shape. When the market pauses, the flag usually bends against the direction of the flagpole, signifying a brief pause in the trend.

Understanding flag trading patterns requires a thorough understanding of volume analysis. Trade volume typically falls as the flag forms, signifying a brief pause in market activity. This is because the market is less active while the price settles. A strong sign that the pattern is true is an increase in volume during the breakout phase.

The breakout is the most important part of figuring out what a flag design means. In a bullish flag, the price will break above the upper line of the flag, usually with more trading volume. This means that the trend will continue to go up. A bear flag trading pattern means that the price will break below the lower limit, which means that the trend will continue to go down.

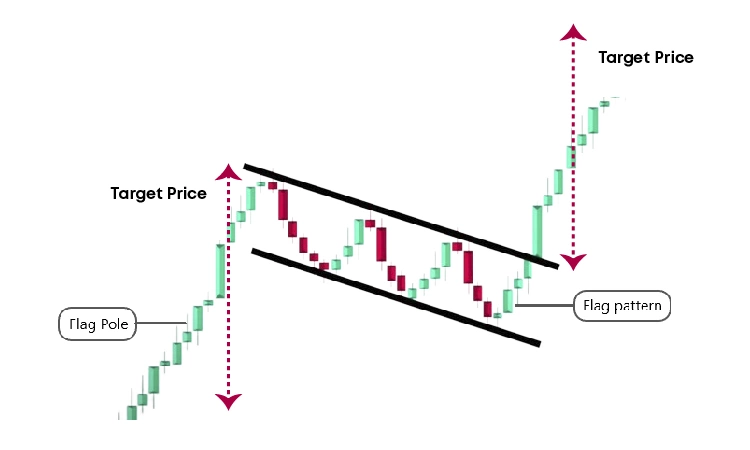

After the breakout, you can guess how the price might move by measuring the flagpole's length and projecting it from the breakout point. This will give a range for how long the continuation will last, which can help to make trade choices.

Types of Flag Patterns

Flag patterns are categorized according to the trend's direction and the consolidation phase's orientation.

Bullish Flag Pattern

A bull flag pattern develops during an upward trend. It starts with a strong upward price movement, which creates the flagpole. After this, the price stays in a channel with a falling slope or a straight range, which makes the flag. The breakout happens when the price crosses the upper border of the flag, indicating that the uptrend will continue.

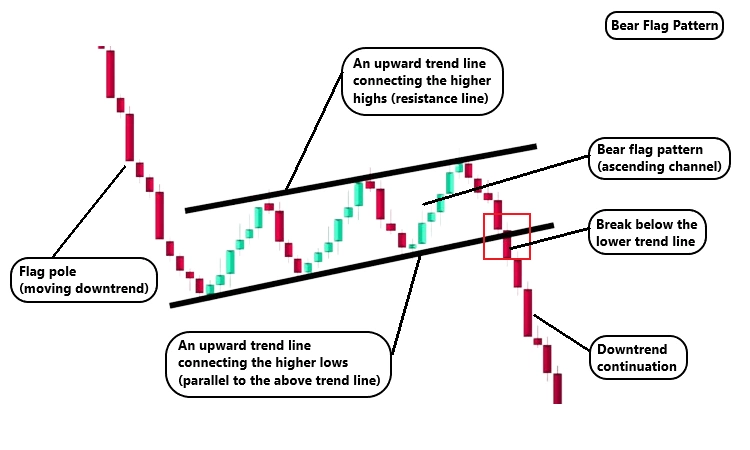

Bearish Flag Pattern

A bearish flag trading pattern shows up when prices are going down. It starts with a sharp price drop, which leads to the flagpole. The price then stays in a channel that goes up or a horizontal range, which makes the flag. At the breakout, the price falls below the lower edge of the flag, showing that the decline will continue.

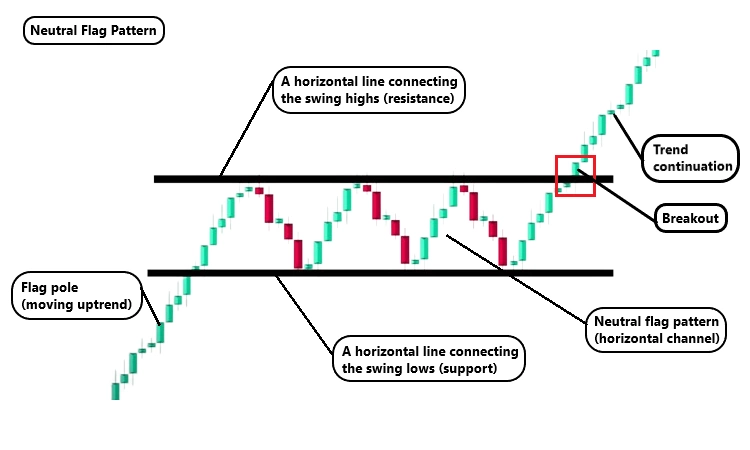

Neutral flag pattern

The neutral flag pattern does not strongly suggest that the price will continue to go up or down. Instead, it's a time of stability within a larger trend, but with a less clear leaning in one way. Like other flag patterns, this one has a flagpole and a flag, but it's not always easy to tell which way the breakout will go.

These flag patterns help traders figure out if a trend will continue, which lets them make smart buying decisions.

Bullish Flag Pattern

As a technical analysis, a bull flag pattern shows that a rise can continue. According to technical analysis, a positive flag pattern means that a rise will continue. The shape starts with the flagpole, which has a strong and obvious upward price movement. A high price increase shows strong buyer interest and sets the stage for the pattern.

A bull flag pattern is a reliable way to see that an upswing will continue. It is made up of a strong rise at the beginning (the flagpole), a period of consolidation (the flag), and then a breakout that shows the movement will continue.

The drop in trade volume during the formation of the flag is an important part of the bullish flag pattern. This drop in volume means that the market is taking a short break, with fewer buyers and sellers actively dealing. The bull flag pattern is confirmed when the price breaks above the top border of the flag, followed by a volume increase. The breakout means that the uptrend is back on track, which could be a good time for traders to buy.

Traders predict how the price might move after the breakout by measuring the flagpole's length and projecting it from the breakout position. Setting price goals and handling trades well are easier with this projection.

Bear Flag Pattern

According to technical analysis, a bear flag pattern means that a decline might continue.

The flagpole is the first part of the pattern. It has a steep and large downward price movement. The bearish trend is set by this sharp drop in price, which shows strong selling pressure.

After that, the price goes into a phase of stabilization, which makes the flag. During this phase, the price stays in a small range and usually moves in a rectangular shape, either going up or down.

The drop in trade volume during the formation of the flag is an important part of the bear flag pattern. As the number drops, it means that the market is taking a short break, with fewer people actively buying and selling.

If the price breaks below the lower edge of the flag, along with a rise in volume, this means that the bear flag pattern is real. This breakout shows that the decline is back, which could be a good time for buyers to sell.

Traders predict how the price might move after the breakout by measuring the flagpole's length and projecting it from the breakout position.

Neutral Flag Pattern

When a neutral flag pattern forms, it starts with the flag, which can be a fast price move up or down, showing the first strong trend.

After the flagpole, the price goes into a phase of stabilization, which makes the flag. The price moves in a narrow range during this phase, making a form that looks like a rectangle or trapezoid. In a neutral design, the flag can move sideways, slightly up or down, or with a small slope, but the slope is not strong enough to show a clear bias.

When the flag forms, volume tends to go down, which means that trade will slow down while the market consolidates. All in all the neutral flag pattern means that the market is balanced, and buyers and traders maintain their balance.

Traders have simpler plans when it comes to bullish or bearish flag patterns than neutral patterns. It can be hard to decide what to do because these patterns don't give you a clear action plan.

How to Trade Flag Patterns (Advanced Strategies)

Trading flag patterns techniques can make the deals more profitable and useful. Using these advanced tactics in flag pattern trading can help traders make more accurate deals. Here is an in-depth look at how to trade flag patterns using advanced strategies:

Pullback Entry

Traders employ pullback entries to enter a position following a flag pattern breakout. Before entering, traders wait for the price to fall back to the breakout level, which typically functions as support or resistance in bullish and bearish flags.

- Identify the Breakout: First, recognize the breakout from the flag pattern. For a bullish flag, the price breaks above the upper boundary of the flag. For a bearish flag, the price breaks below the lower boundary. Ensure this breakout is confirmed by an increase in trading volume, signaling strong market interest in the direction of the breakout.

- Wait for the Pullback: Wait to enter after the breakout until the price returns to the breakout level. This retreat retests the breakout. Breakouts are supports for bullish flags and barriers for bearish flag patterns. The pullback may take time to reveal.

- Confirmation of Support or Resistance: Once the price returns to the level where it broke out, look for signs that it will stay there as support or resistance.

- Enter the Trade: When you see proof of the breakout level, make a trade in the direction of the breakout. If the flag is bullish, go long, and if it is bearish, go short.

- Set Stop-Loss Orders: To protect yourself from price changes, put in a stop-loss order. This keeps your losses as low as possible in case the breakout doesn't work and the price moves against your trade.

Using Flags to Get Through Key Levels

Flag patterns can help you find your way through the market's key support and resistance levels. These levels are important because they often stop prices from moving, and when they are broken, prices can change a lot.

- Find the key levels: On a chart, key levels are straight lines that show important levels of support or resistance. A price drop usually stops at support levels when people want to buy, and a price rise usually stops at resistance levels when people want to sell.

- Find the flag pattern: Watch for flag designs that appear at key levels. These patterns show price consolidation following a big move. Bullish flags with key resistance levels suggest a breakout above that level, while bearish flags within key support levels signal a collapse below that level.

- Volume Confirmation: Volume is an important part of confirming breakouts through key levels. Make sure that the number goes up during the flagpole formation to show that there is great interest in buying or selling. Volume should drop during the consolidation phase (the flag), which means there will be a short break.

- Price Breakout: Wait until the price breaks through the key level. If you see a rising flag close to resistance, it means that the price goes above the resistance line. When there is a downward flag close to support, the price goes below the support line. It's important that the breakout is clear and final, not just a short-term rise.

- Confirm the Breakout: Make sure that the breakout is real and not fake. Price should stay above the key level for a while, trade volume should go up, and there shouldn't be any reverse patterns going the other way after the breakout.

- Set Stop-Loss Orders: To reduce possible losses, put stop-loss orders. If the flag is bullish, put your stop-loss below the lower edge of it. If the flag is bearish, put it above the upper edge. Change the size of your trade depending on how far away your stop-loss is.

Using Flags to Trade Breakouts. How to Trade Breakouts with Flags?

Flag patterns are useful for trading breakouts because they give traders an organized way to make money from big price changes.

- Confirmation of the Flag Pattern: Flag pattern identification comes first. The flagpole and flag are both vital pieces, and the flagpole signifies major buying or selling pressure.

- Clear Breakout: To minimize false signals, the breakout should be clear and loud.

- Entry timing: A clear breakout with strong volume is the best time to enter the market. Wait for a drop to the breakout level before getting into the trade right after the breakout.

- Measuring price targets: To set market goals, find the flagpole's length and estimate it from the point where the price broke out. This gives an outline of where the following move should go.

- Trade monitoring: Monitor trades after entering. Monitor price strengths and weaknesses to adapt your target plan. If the price achieves your profit objective sooner than planned, close the transaction or change your stop-loss to lock in profits.

Risk Management and Considerations

Traders can successfully control their risk when trading flag patterns by taking these risk management strategies and factors into account. This will increase their chances of long-term success and profitability.

- Position Sizing: Choose the size of your trade based on how much risk you are willing to take and how far away your stop-loss is. It is generally recommended to risk only a small amount of your budget on each trade. This amount should be up to 3% of your total trading capital. Your risk tolerance and the distance to your stop-loss will help you decide how big of a trade to take. This keeps your general capital from being greatly affected by lost trades.

- Overtrading balance: Too much trade can cause big losses and cause people to make bad decisions. When you trade, follow your plan and only make trades that meet your standards. Do not chase trades or start trading without analyzing.

- Volatility and market conditions: When trading flag patterns, you should look at the market as a whole and how volatile it is. Price changes and false breaks can happen quickly when there is a lot of instability, and accordingly, change your stop-loss and trade size as needed.

- Trading diversity: Spending all of your trading money on one product or trade is not a good idea. Diversify your risk by holding a lot of different products or markets. As a result, one lost trade has less effect on the whole portfolio.

- Review and changes: Review your trades often and make changes based on how they're performing and how the market behaves. Along with helping to maximize wins and protect against reversals, stop and analysis help to detect price moves.

Conclusion

To trade flag patterns successfully over the long term and avoid big losses, traders need to be able to control their risks well. To control threats when trading flag patterns, here are some important things to keep in mind:

Using trading flag patterns can be a very good way to make profits from market trends and breaks. When paired with good risk management, these trends give you clear entry and exit points that can help you do better trading. Traders can increase their chances of making money by learning how flag patterns are put together, checking breakouts, and volume, and using pullback enters.

Using advanced tactics like integrating analytical indicators, and keeping up to date on market conditions can make trading flag patterns even better. Investors can protect their money and achieve long-term success by regulating risk by placing the right stop-loss orders, keeping a good risk-reward ratio, and not dealing too much.

FAQ

What are the types of Flag Patterns?

Bear, bull, and neutral flags are the three types of flag chart patterns.

What are the visual characteristics of a flag chart pattern?

A flag pattern on a chart looks like a sharp price change (a "flagpole") followed by a phase of stabilization in the shape of a rectangle.

What is the price target for the flag pattern?

When there is a flag pattern, the price goal is the height of the flagpole that runs from the point of breakout.

How accurate is the flag pattern? (Success Rate)

The flag pattern has a mixed success rate, but it tends to be very accurate in trending markets.

Is a flag pattern bullish?

Based on the trend that came before it, a flag pattern can be either bullish, bearish or neutral.

What is the flag trading strategy?

Trading with the flag trading strategy means making a trade at the flag's breakout point and setting a price goal based on the height of the flagpole.

What is a flag breakout?

A breakout is when a trend price moves beyond support or resistance lines, indicating that the trend will likely continue in the breakout direction.

What is the flag pattern in a downtrend?

A flag design that shows prices going down is known as a "bear flag," and it means that prices will continue to go down and the pattern is a downtrend.

What is the flag pattern in an uptrend?

A flag design that shows prices going up is known as a “bull flag," and it means that prices will continue to go up and the pattern is an uptrend.

By keeping with these tips and always improving your trading strategy based on market feedback and performance reviews, you can use flag patterns to find key levels, and trade breaks, and make your trading strategy better overall.

Disclaimer: Includes third-party opinions. No financial advice.