On This Page

- What is Tokenization?

- What are Real-world Assets (RWAs)?

- Real-World Assets Digitization

- Unlocking Value in Every Atom: From Art to Commodities and Beyond

- Market Opportunity and Stats

- Tokenization's Power Play: Benefits for All

- Case Studies and Success Stories

- Challenges and Future Outlook

- Conclusion

- FAQ

Tokenization of Real-World Assets

The idea of tokenization became a revolutionary force that combines traditional and digital assets in the quickly developing finance and technology world. The following article shows how real-world assets, such as stocks, real estate, and artwork, are represented as digital currencies on blockchain systems. The blog reveals the tectonic change across various industries such as financial and governmental sectors, and intellectual property, as a result of encrypting physical assets into flexible tokens. Discussing study cases and success stories, the article shows how businesses are investigating and adjusting to real-world asset tokenization.

What is Tokenization?

Tokenization is the process of turning real-world assets (RWA), like real estate or art, into digital tokens on a blockchain. This makes assets easier to trade, share ownership, and manage through transparent and secure digital transactions. Using a variety of token development solutions will help to maximise your business opportunities.

What are Real-world Assets (RWAs)?

Real estate, artwork, commodities, and even intellectual property are instances of real-world assets. Such digitization of physical assets creates greater liquidity, transparency, and fractional ownership and is often considered a means of modernizing and expanding traditional financial markets. The blockchain technology transforms physical assets into digital tokens, allowing easier trading. For example, a multi-story apartment complex contains unit accounts as percentages of the overall property value. By tokenizing these units, investors can easily become partial owners.

Real-World Assets Digitization

Tokenization of real-world assets is the process of creating a blockchain-based digital token for an asset. It simplifies the splitting of assets into smaller, more manageable parts. In this approach, digital tokens on a blockchain are used to represent the ownership and value of these assets. Accordingly, it allows fractional ownership and increases the accessibility of high-value assets to a wider range of investors.

Let's say it was your job to take a valuable asset, like a piece of real estate, and turn its worth and ownership into digital tokens. Then, a blockchain is used to safely record these tokens, each of which represents a portion or share of the original asset. The asset is divided into smaller, more manageable, and tradeable portions, allowing fractional ownership.

Unlocking Value in Every Atom: From Art to Commodities and Beyond

Covering more than just real estate and art collections, tokenization of real-world assets also includes infrastructure, data, games, collectibles, art, and entertainment. Such a wide range of acceptable assets shows that almost any kind of value may be easily recorded and transmitted digitally.

Tokenization thus offers way possible advantages to a wide spectrum of players. Large companies and top fund groups have already tokenized a portion of the assets they oversee. Also, many economic sectors have already adopted tokenization into their day-to-day activities.

- Financial Industry: In the financial sector, tokenization improves accessibility, liquidity, trading, and asset management efficiency. Financial services can benefit from it in a variety of ways, such as custody, assistance, and training for investing in tokenized assets. Stablecoins and tokenized deposits, two blockchain-based payment solutions provide new channels for safe and effective financial transactions. In general, tokenization is changing how traditional financial processes are carried out by using blockchain technology to produce digital representations of value. This is an encouraging innovation and opens up new prospects for the sector.

- Governmental Sectors: Through the use of tokenization government assets will become more traceable and visible, encouraging responsible use. Furthermore, it can be broadly applied to the transparent and safe distribution of subsidies and benefits.

- Electricity and Utility: Tokenization makes funding and sustainability monitoring easier in the electricity and utilities sectors by opening up investment opportunities.

- Real Estate: Tokenization of real estate refers to dividing the properties into tiny pieces that may be bought and sold on a liquid market. This will make real estate investing more accessible to everyone by enabling them to easily transfer properties or shares.

- Tokenized intellectual property (IP): Encryption of intellectual property (IP) refers to using digital tokens on a blockchain to represent ownership of trademarks, patents, copyrights, and other IP assets. This makes it possible to have fractional ownership, trade for liquidity, be transparent, and employ smart contracts. It can open up international markets, improve security against unlawful usage, and democratize access to intellectual property investments.

Market Opportunity and Stats

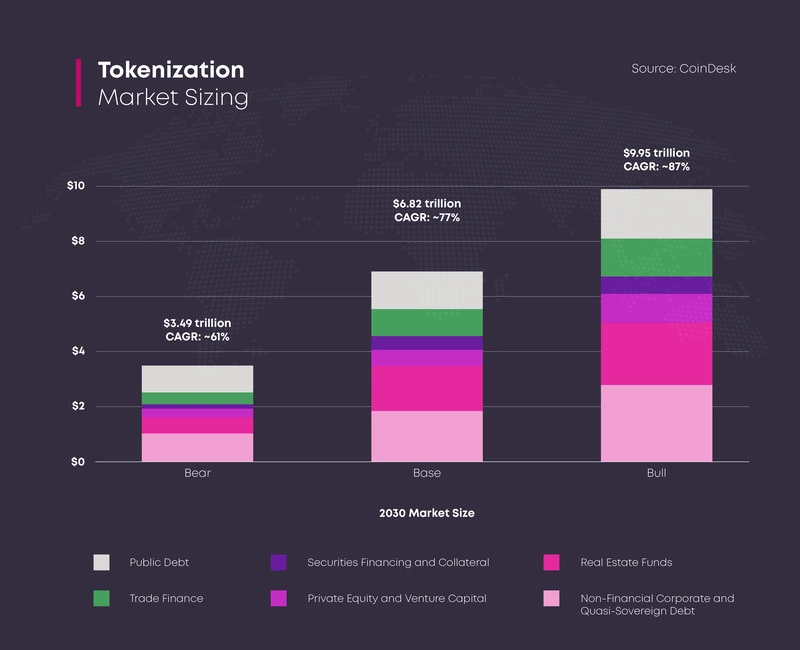

The development of real-world asset tokenization can potentially revolutionize the native currencies' finance system. Although RWA tokenization is still in its early phases, there are already statistics collected. Several factors, such as changes in regulations, advances in technology, and general trends in the blockchain and cryptocurrency business, can affect market circumstances.

Being a leading source for blockchain and cryptocurrency news, CoinDesk provides analysis reports according to which the tokenized assets market can reach $10 trillion in a "bull case" and $3.5 trillion in a "bear case". A bear market is decreasing, whereas a bull market is increasing. Both of these terms are frequently used for extended periods of mainly rising or decreasing trends in markets because of daily fluctuations.

Tokenization, according to a report by Bank of America, has the potential to revolutionize the current financial infrastructure and improve supply chains while lowering costs and increasing efficiencies.

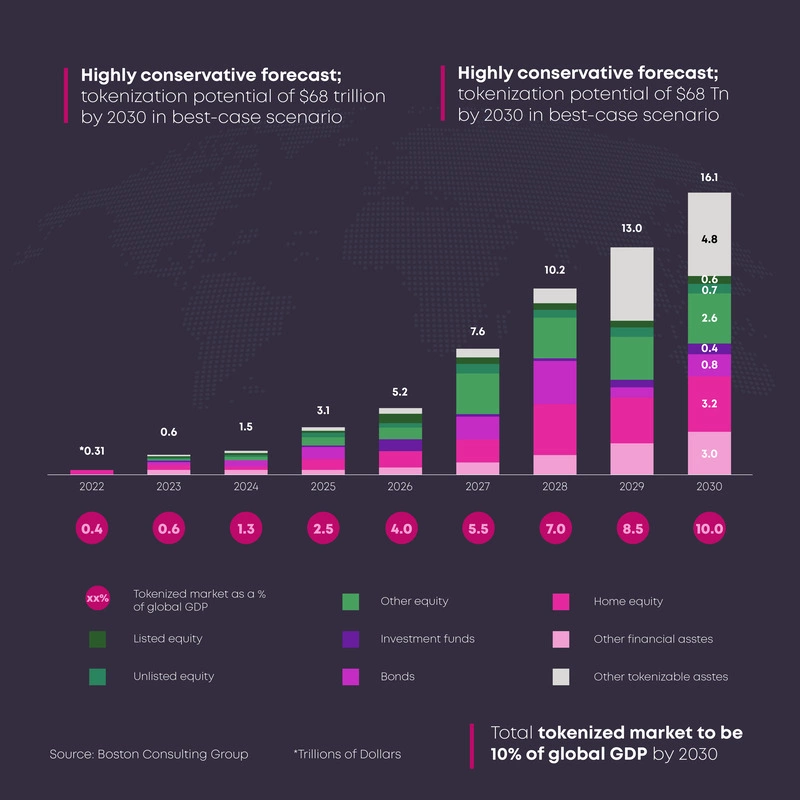

According to Boston Consulting Group research tokenized assets would grow to a value of $16 trillion in 2030.

It’s important to mention that the RWA market is dominated by leading companies that foster growth and innovation. With their knowledge of financial services and blockchain technologies, companies like American Express and Fiserv are important in determining the direction of tokenized RWA. Also, the tokenization market rate has impacts from global politics such as the Russian-Ukrainian war.

How Businesses Can Start Their Tokenization Journey

Starting your real-world asset tokenization journey is quite similar to starting any valuable project. It is needed to evaluate and determine the initial tokenization potential in your company. After the assessment of your strong tokenization plan carry out the key use cases. You should be sure that the technology selected fits perfectly with your specific use case. This journey is a competitive environment in which the following steps are essential:

- Finding and investigating several blockchain systems that are appropriate for your tokenizing assets

- Platform selection (such as Bahamut, Ethereum, Binance Smart Chain, etc.) that fits both your business needs and the kind of assets you want to tokenize.

- Community involvement and developer support for the selected blockchain platform.

- Compliance protocols creation and record to guarantee the real-world asset tokenization process is transparent.

- Active online presence on social media channels to foster community engagement.

Tokenization's Power Play: Benefits for All

Real-world asset tokenization has the potential to advance financial inclusion by opening up investment opportunities to a wider range of people. Such democratization of access to assets will help to boost economic growth.

- Improved liquidity: Enabling the buying and selling of tokens on digital marketplaces with improved liquidity.

- Democratization: More people can now afford to own a portion of high-value assets that were previously out of reach, making a huge investment in the history of global financial development.

- Confidence: More confidence in the management of digital assets because of the security and transparency provided by blockchain technology.

- Efficiency: Tokenization has the potential to completely change our view of traditional assets in the current digital world.

The tokenization of real-world assets process has a revolutionary impact on investors, businesses, and the overall economy by providing simplified financial procedures, more liquidity, and chances for inclusive economic growth.

Businesses: RWA tokenization reduces administrative costs related to traditional assets and speeds up fundraising procedures for companies. It also provides faster access to funds through fractional ownership.

Investors: Greater liquidity, fewer entry barriers, and wider access to a variety of assets, which can lead to higher returns.

Economy: By increasing chances for small and medium-sized businesses, tokenization promotes economic growth and eventually builds a more robust and dynamic financial ecosystem.

Case Studies and Success Stories

More and more businesses are investigating and adjusting to real-world asset tokenization in the dynamic finance and technology world.

PAX Gold demonstrates how RWA tokenization may improve the efficiency, transparency, and accessibility of traditional assets. PAX Gold allows investors to purchase and trade expensive metals more easily by allowing fractional ownership of tangible assets like gold. As a result, the commodities markets become more efficient. PAXG gives investors an affordable option to hold actual gold that is suitable for investment with all the advantages of the blockchain. This project is an illustration of how blockchain-based solutions have the potential to change the field of investing and commodities trade.

Challenges and Future Outlook

According to the World Bank, around 1.7 billion people do not currently have access to financial services. They do not, therefore, own a bank account, credit card, or any other type of financial product that would enable them to take out loans, save, or make investments.

On the one hand, this may take time to adapt and understand how the world of the financial industry works. On the other hand, tokenizing real-world assets can open new opportunities directly for people who avoid sharing their sensitive information through transactions.

Also, the RWA tokenization ecosystem can develop its full potential of revolutionary ideas by only resolving regulatory issues, enhancing technology capabilities, and increasing market awareness. Technology developers, regulators, and industry stakeholders must work together to overcome these obstacles.

Conclusion

To sum up, the implementation of tokenization for real-world assets is creating a strong connection between traditional and decentralized finance. Moreover, beyond the world of cryptocurrency enthusiasts, small-fund investors are also being welcomed to employ such revolutionary adoption which is being integrated not only for cryptocurrency fans but also for those who employ fractionalization to invest in high-value assets. Tokenizing real-world assets opens up new channels for capital formation and promotes a more diverse and robust financial environment.

FAQ

How can tokenization improve real-world asset liquidity?

Tokenizing real-world assets makes fractional ownership easier by allowing investors to purchase and sell smaller amounts of an asset which guarantees its liquidity.

What advantages may tokenizing physical assets offer?

The benefits of tokenizing real-world assets include lower transaction costs, more accessibility to a worldwide investor base, and higher transparency.

Is tokenization legal and what are the regulatory considerations?

The determining factors are the legal rights that the tokens represent and the existence of a suitable market that enables their use.

What are the best-suited asset types for tokenization?

Generally, the following asset categories are thought to be well-suited for tokenization: Art and Collectibles, Real Estate: Precious Metals and expensive artifacts: and intellectual property (IP).

Disclaimer: Includes third-party opinions. No financial advice.