On This Page

- What is Bitcoin halving and how often does it happen?

- How does the Bitcoin block reward system function and what does the halving bring?

- What are the potential impacts of a Bitcoin halving?

- When is the next Bitcoin halving expected?

- How might investors react to the changing supply dynamics after the 2024 halving?

- Conclusion

- Must Read Content

Bitcoin Halving: All You Need to Know

The Bitcoin halving countdown has begun, and it is shaping up to be the most significant crypto event of 2024.

What is Bitcoin halving and how often does it happen?

One of the most discussed topics currently raging in the crypto world is the next Bitcoin halving event, the fourth in the asset’s history. It is commonly known as the "halvening," a programmed action occurring on the Bitcoin network.

How does it work and what exactly does it mean for Bitcoin?

Bitcoin halving regulates the amount of Bitcoin rewards issued to miners for helping to secure the network. Accordingly, the reward for miners is cutting in half every 4 years resulting in them earning just half of the BTC quantity for every mined block. The next halving event is predicted to be in April 2024 and can have a significant impact on mining profitability, the price of Bitcoin, liquidity, and global transaction volume as this event will lower the global earnings from mining.

How does the Bitcoin block reward system function and what does the halving bring?

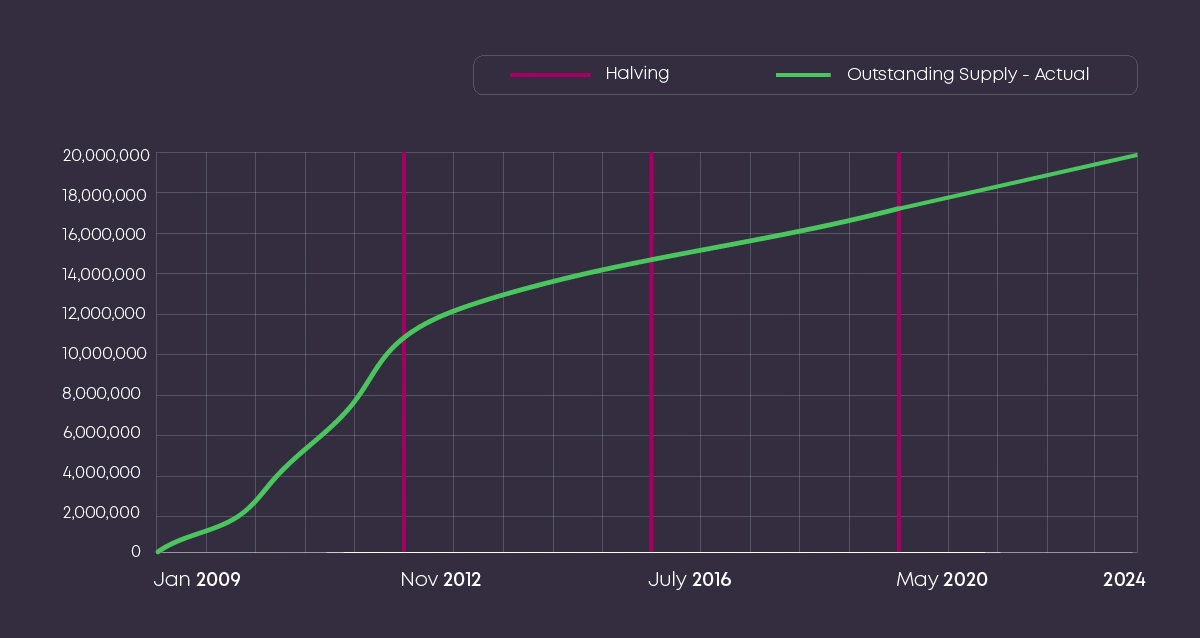

The block reward program on the Bitcoin system motivates miners to validate transactions and protect the blockchain. Every four years the block reward for Bitcoin is reduced in half, which will continue until all 21 million bitcoins are generated. The upcoming halving may cause the price of Bitcoin to fall in the short-term and increase in the medium-term, although not to the same level that previous halvings have shown.

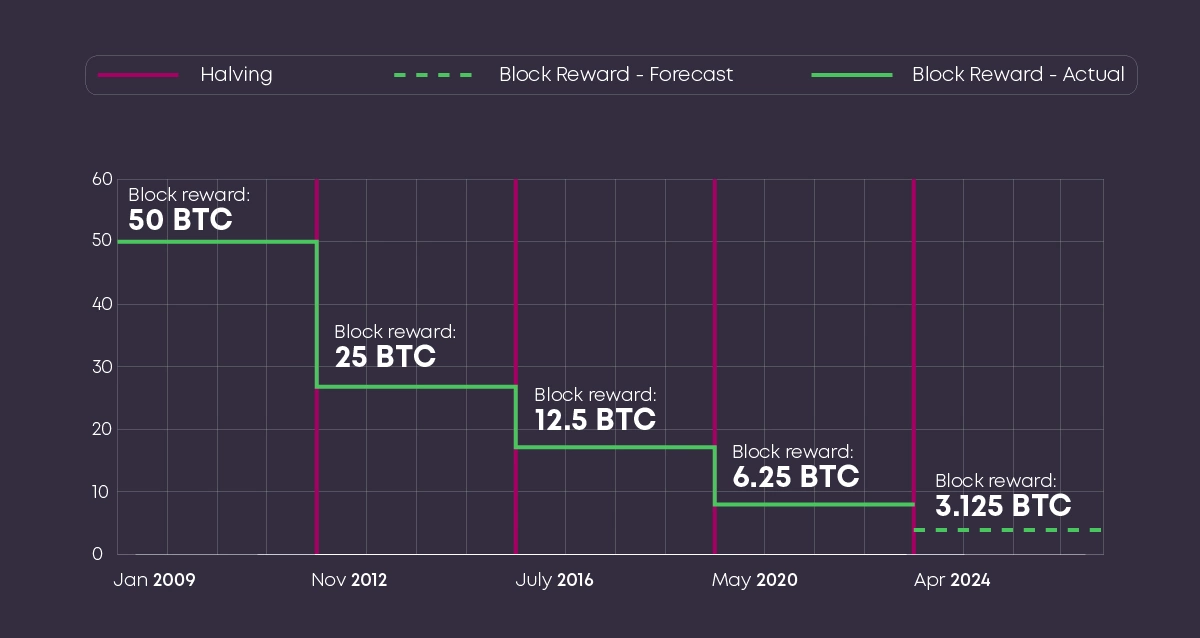

Since its creation in 2009 Bitcoin mining reward was 50 BTC for each block. Since then, there have been three halvings. The first one took place in November 2012, reducing the mining reward from 50 to 25 BTC. The next BTC halving occurred in July 2016 decreasing it to 12.5 BTC. The third halving cut the reward to 6.25 BTC per block in May 2020.

What are the potential impacts of a Bitcoin halving?

Bitcoin halvings have a huge impact on the entire cryptocurrency world.

As block rewards decrease, some miners may quit operations since they are no longer profitable due to increasing costs. Accordingly, the expected drop in hash rate might impact Bitcoin's price. This is a risk that some miners will capitulate because of lower revenues. Their sudden and massive capitulation might cause a threat to the network. Such a significant drop in the hash rate might eventually trigger a negative feedback loop, with a major drop in the hash rate weakening confidence in the network, resulting in a lower bitcoin price, which in turn lowers miners' earnings, driving more miners to fold.

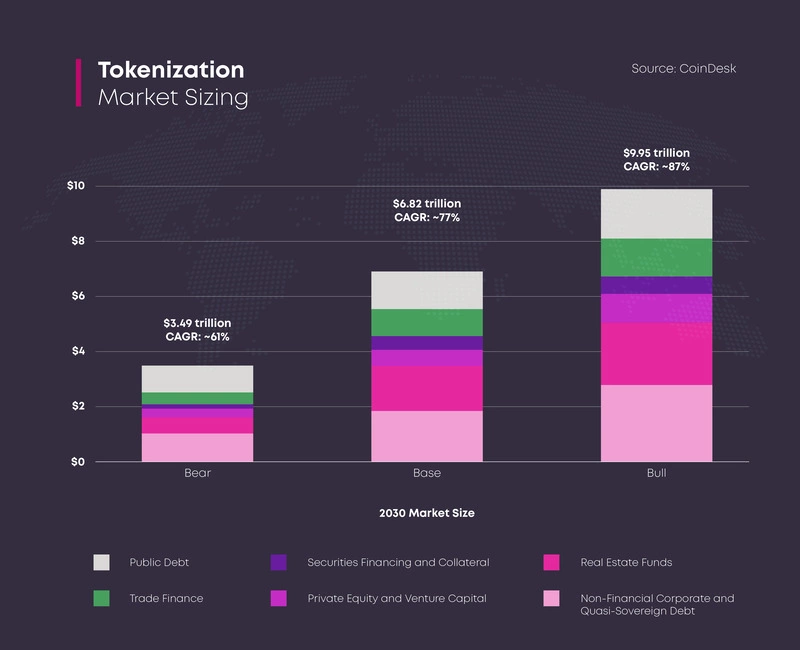

Also, the halvings generate attention and encourage investment, resulting in growth in other cryptocurrencies. This excitement may result in increased investment in altcoins, boosting their prices. Investors may gain confidence in the future price increases of other cryptocurrencies. Accordingly, as Bitcoin's mining motivation decreases, some miners may migrate to mining Altcoins that provide higher returns.

These changes show how influential Bitcoin halving is on the broader crypto economy.

When is the next Bitcoin halving expected?

Bitcoin halvings have happened three times in the past, and the coming one is expected to happen in April 2024.

Bitcoin halvings are scheduled to occur every 210,000 blocks, or approximately every four years until the network achieves its maximum total supply of 21 million BTC in circulation around 2140.

What is the market's expectation for the 2024 halving?

Halving affects the crypto economy by reducing the rate of market supply.

The dynamics were quite different at the time, and numerous factors such as supply, retail investors, and global cataclysms had their forces resulting a greater demand and probable price changes.

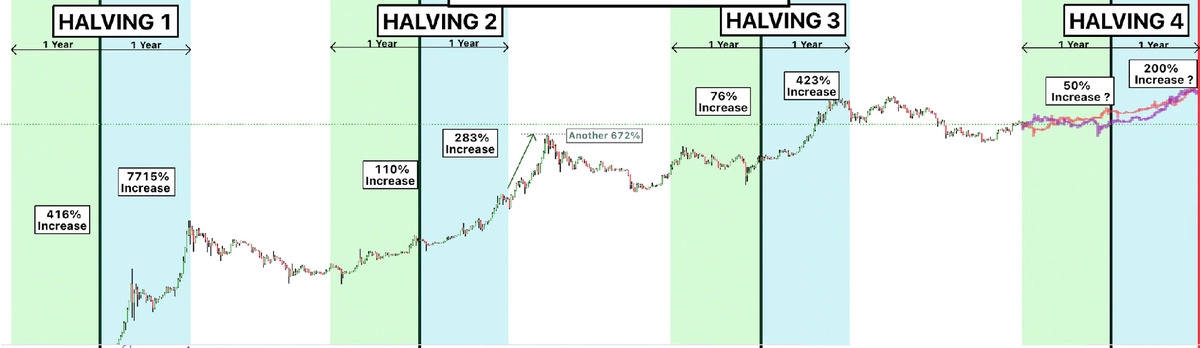

According to Tradeview Bitcoin’s before and after halving price performances show the following halving dynamics:

1. 26th Nov 2012 - Pre 416% / Post 7715%

2. 9th July 2016 - Pre 110% / Post 283% (The full move including after the 24-month period was c.955%)

3. 11th May 2020 - Pre 76% / Post 423%

4. 27th April 2024 - Pre 50% / Post 200%

The next bitcoin halving expects to reduce the block reward to 3.125 each block limiting the total number of Bitcoins. As a result, the number of Bitcoins in circulation decreases while demand remains steady or increases. Accordingly, the possibility of a price rise increases.

How might investors react to the changing supply dynamics after the 2024 halving?

The crypto community, including investors, miners, and fans carefully look ahead to the 2024 halving event because of its impact on the Bitcoin value and the entire crypto market. The halving event can affect critically any investment and bring huge market changes. And as the halving process increases scarcity, the attraction interest in Bitcoin trading is expected to grow.

The circumstances can vary every four years in every halving, considering that cryptocurrencies are very unpredictable assets affecting the crypto world economy.

Conclusion

Bitcoin halvings have a huge influence on price fluctuations, mining economics, investor careers, and long-term supply patterns.

Such unpredictable dynamics of events may highlight the significance of considering historical trends, market analysis, and risk management strategies when navigating the impact of halving events on Bitcoin prices and investment decisions.

Still, having so much analysis we believe that as time passes, halvings will represent less and less supply cut as a percentage of the outstanding supply, and we expect subsequent occurrences of such events to have a lesser impact on the network economics.

Must Read Content

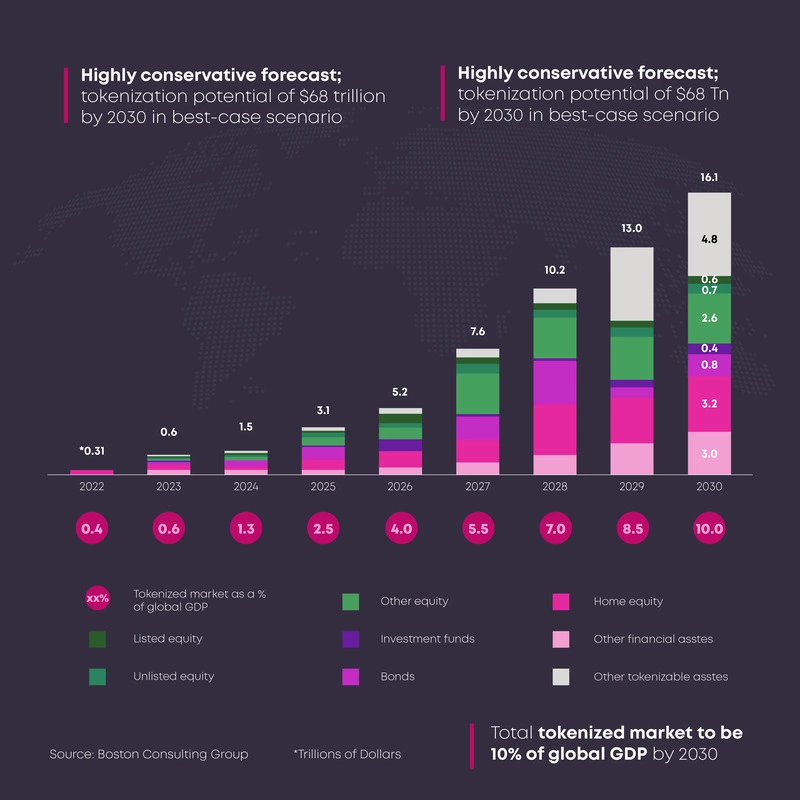

Discover what’s the magic behind innovative financial units, why are they so popular, and what stands behind the buzz.

Understanding Crypto Chart Patterns

Learn unique chart characteristics, shapes, sizes, and formations for a better trading experience.

How to Diversify Your Crypto Portfolio

Take a closer look at the key strategies for diversifying your cryptocurrency investments.

Disclaimer: Includes third-party opinions. No financial advice.