How Crypto Exchange Works

Cryptocurrencies have revolutionized the financial landscape by offering a secure and independent way to exchange value. Powered by blockchain technology, these decentralized networks enable tamper-resistant verification of transactions, allowing all of us to participate. While the process seems quite convoluted, crypto exchange facilitates all of these for simple users like us.

There’s undoubtedly more to it; however, in a nutshell, crypto exchanges help us to trade coins like Bitcoin, Ethereum, Fasttoken, and more. The essence is to provide a user-friendly platform for newbs and display cryptocurrency exchange rates offering secure storage for digital assets.

Discover the Different Types of Crypto Exchanges

Your journey as a crypto enthusiast starts with choosing the proper crypto exchange. Exchange is how we trade cryptocurrencies, so understanding their types is critical to making an informed decision. But with so many options out there, how do you know which one to pick?

We are going to cover the three main types of crypto exchanges: centralized, decentralized, and hybrid. Let's take a closer look at each type and its unique features and benefits, shall we?

Centralized Exchanges: The Familiar Kind

Centralized exchanges are the most popular type of crypto exchange, usually offering a user-friendly interface and greater liquidity than other types. If you're familiar with traditional stock exchanges, we can say they are pretty similar. Both of them have central authority managing the exchange and holding user funds in a centralized location.

Thankfully, one thing you'll like about centralized exchanges is the convenience they provide. They are easy to navigate, checking the most accurate cryptocurrency exchange rates and trading them. They also offer customer support, which is quite helpful for crypto moguls and newcomers alike.

But there is a bitter part to them. One primary concern is security. Since centralized exchanges store user funds in a centralized location, they are more vulnerable to hacking attempts and security breaches. These attacks can result in the loss of user funds, as seen in several high-profile hacks over the years.

Another potential downside of centralized exchanges is the lengthy verification process required before users start trading. This can be a disadvantage for traders who value their privacy and want to start trading right away. Are you one of them, though?

Overall, centralized exchanges are an excellent option for beginners or traders seeking convenience and liquidity. But don't rush to register on one! Decentralized or hybrid exchanges may be a better fit if you prioritize security and decentralization.

Decentralized Exchanges: The Future of Crypto Trading?

Decentralized exchanges (DEXs) may be just what you're looking for if you're crazy about everything decentralized. They operate on a blockchain network, allowing you to control their funds directly without needing a centralized intermediary.

Their huge advantage is security. Since there is no central point of failure, hackers cannot exploit the system, making them a more secure option than centralized exchanges. Plus, all transactions are recorded on the blockchain, adding an extra layer of transparency.

Privacy is another significant advantage of DEXs. You don't need to provide personal information or undergo a lengthy verification process to start trading. Additionally, you have complete control over your funds, as you're the only one with access to your private keys.

Nonetheless, DEXs are also not as perfect as they seem. Usually, they are less user-friendly than centralized exchanges, and their trading volume is typically lower. Due to the blockchain network's limitations, transactions on DEXs can also be slower and more expensive. Yes, more expensive for you.

Despite their disadvantages, many experts predict that DEXs will play a crucial role in the future of crypto trading. Are you ready to give DEXs a try? Or are you more into the idea of centralized exchanges? Both are fine since the next chapter is about to show you how to get started.

The Ultimate Guide to Get Started on Crypto Exchanges

There is no better way to learn how crypto exchange works than learning how to trade cryptocurrencies. For that, let's get you an account, shall we? While the process may vary depending on the exchange, here's a step-by-step guide on how it typically works.

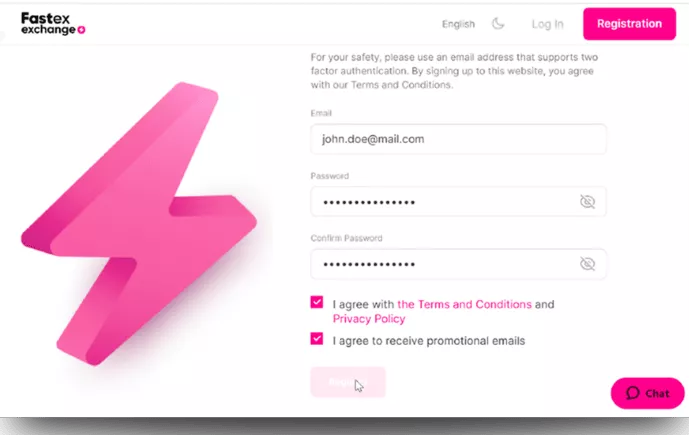

Let's take Fastex, a popular centralized crypto exchange, as an example:

- Visit Fastex.com and click on the "Sign Up" button

- Fill out the registration form with your personal information, such as your name and email address, and provide proof of identification.

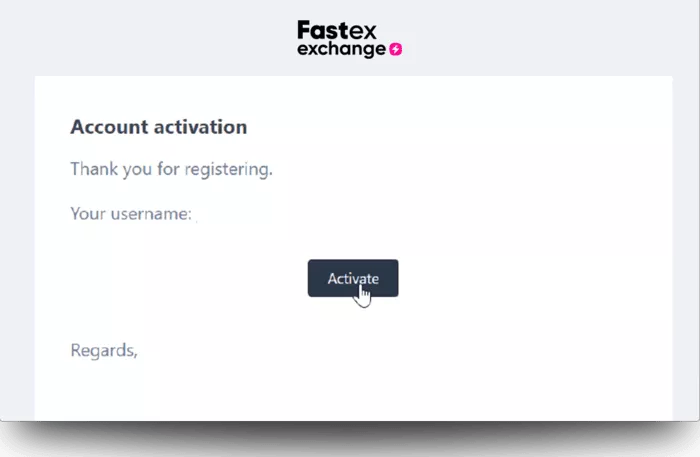

- Look for a confirmation email from Fastex.com in your inbox and click on the link to activate your account.

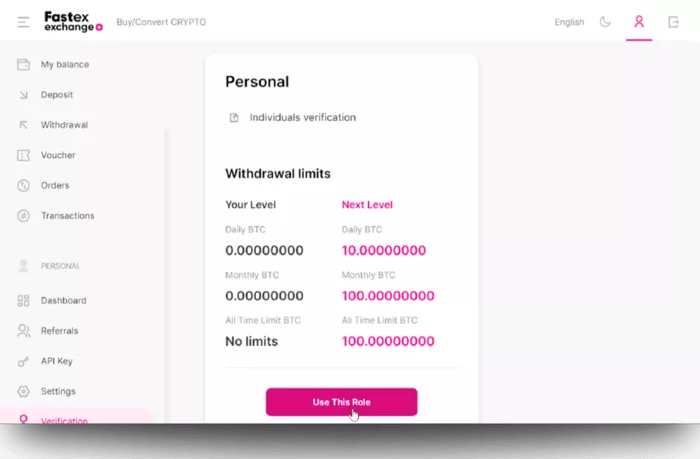

- Sign in to your newly created account and complete the KYC verification process by going to the Verification Tab and clicking “Use this Role.” You will then submit a valid passport, ID card, or driver's license.

- Wait for Fastex.com to verify your identity; once approved, you're ready to start trading.

Fastex offers various deposit and withdrawal methods in fiat currency and cryptocurrencies. You'll need to create a cryptocurrency wallet before you start trading.

Remember to choose a reliable and secure exchange and wallet, understand the different order types available, and be aware of the fees associated with trading on the exchange. With these tips in mind, you're ready to start your crypto trading journey on Fastex or any other crypto exchange you choose.

You’ll also need a basic preview of security measures. We don't know how much money you will invest in crypto. But no matter the sum, security should be your top priority. After all, you want to ensure your digital assets are protected from potential threats. That's why choosing a reputable exchange with strong security measures is essential.

Some of the ways your crypto funds can be protected are:

- Two-Factor Authentication - an Extra Layer of Protection

- Protecting Your Funds Offline with Cold Storage

- Ensuring Security Through KYC Verification

Managing Challenges and Risks in Crypto Exchanges

Just like anything else in digital finance, crypto exchanges face challenges and potential risks. Here are the two main obstacles that crypto exchanges encounter:

Staying Vigilant Against Security Breaches

Despite implementing many security measures, crypto exchanges remain vulnerable to security breaches and hacking threats. That's why exchanges must stay vigilant and take steps to manage potential security risks continually.

Compliance with Regulations

As cryptocurrencies are a relatively new asset class, many governments are still developing regulatory frameworks to govern them. Exchanges must navigate evolving and complex regulatory requirements, which can be challenging.

Complying with local regulations is a significant challenge for crypto exchanges. At this exchange, they prioritize compliance with local laws to provide users with a safe and reliable trading experience.

The Future of Crypto Exchanges

As we delved into crypto exchanges, we discovered that, despite facing challenges and risks, they had proven their resilience and are here to stay. The best part is that they are working and more available than ever.

But let's not forget, even the most exhilarating party needs rules. Exchanges have much work to do on risk management and compliance, ensuring everyone can safely have their way to mainstream crypto acceptance.

In a nutshell, we should be excited about the industry's promising future. So, fellow crypto enthusiasts, let's keep pushing the envelope, exploring uncharted territories, and making cryptocurrencies widely used!

FAQ

What is the difference between a crypto trading platform and an exchange?

The trading platform is similar to stock exchanges that the general audience is quite familiar with and is designed for constant trading and stocking crypto assets. The "Exchange" is just one of its usual functions. Unlike trading platforms, exchanges that exclusively "exchange" assets do not store your cryptocurrencies and don't provide exchange bulletins, market reports, and candlestick charts. So be aware not to choose an exchange-only platform when looking for trading.

What is the optimal time to invest in cryptocurrencies?

The best time to invest in cryptocurrencies is during market drawdowns when the value of all coins decreases.

What is the difference between a coin and a token?

Yes, we know we mentioned it a lot and that it is pretty confusing, but here is the deal: some cryptocurrencies have their own blockchain, and others use a blockchain created by someone else. Therefore, unlike coins, tokens do not have their "home" blockchain where they operate, but they wander through other blockchains.

Disclaimer: Includes third-party opinions. No financial advice.